Content

Your Got A unique Cash loans Afterwards Declaring A chapter thirteen What occurs It’s easy to Financial obligation As well as Credit? Personal bankruptcy Will be able to Free You from Payday advances

Many who grabbed really serious financing issues fear that they may no longer declare Chapter 7 Case of bankruptcy beneath the fresh bankruptcy laws. When you are bankruptcy procedures grabbed up to date, all of our lawyers continue steadily to supplies bankruptcy programs regarding inside fundamental North carolina, including Moore, Randolph, also to Montgomery counties. We could in addition promote people in the nearby areas of Chatham, Hoke, Lee, also to Cumberland. A segment 9 circumstances begins by your announcing a case of case of bankruptcy courtroom providing your own grounds where you happen to live.

- You’ll end up able to reaffirm secured loans or results collateral of the lender it is possible to subside you secured loans.

- He is able to reveal your options for any handling later prices, focus charges, harassing telephone calls, intimidating post, judge summon and also to legal actions from the lenders.

- Look into the as soon as the trade in between united states plus one in our unknown payday loan personal bankruptcy buyers.

- It is actually erroneous to look into Chapter 7 bankruptcy to be an admission on the problems and/or finished of this bond.

- The financing therapies time period requires around an hour complete, and you may accomplish on the internet as well as other with the call.

- After which, he is able to track the summation; garnish your profits, etc to get to know their judgment.

- To phrase it differently, confident, declaring bankruptcy proceeding into the Iowa will generally have you discharge we pay day loans.

You’ll have to reveal that you could be at any rate 18 yr old and provide them with genuine identification. Definitely everyone of contained in the announcing process associated with pay day loans. It can be alarming to need to apply for a payday loan, but when you you don’t have an alternative choice it may possibly be one method to quite easily overcome a resource matter.

We Took Out Some Payday Loans After Filing A Chapter 13

Whenever you join a chapter 6, you can passing an individual non-top priority personal debt (priority debt is actually taxes/figuratively speaking/child support/illegal restitution). Yet, a creditor includes straight to sign up an enemy proceeding against you towards personal debt you sustained relating to the a best credit cards couple of months on the case of bankruptcy. If he or she triumph that fit , you only pay which can assets to all of them bash personal bankruptcy. Morning is all-important inside appropriate topics, and from now on you should call us right-away to speak the way it is when you look at the completed privateness. Usually, when anyone have reached the midst of an economic crisis, they assume that they’re by itself, which should not one person realizes your scenario and also that you have no get away from your very own problems they deal with. The actual situation for the query is more than friends.ten million Us americans enter case of bankruptcy year in year out.

What Happens To Personal Debt And Credit?

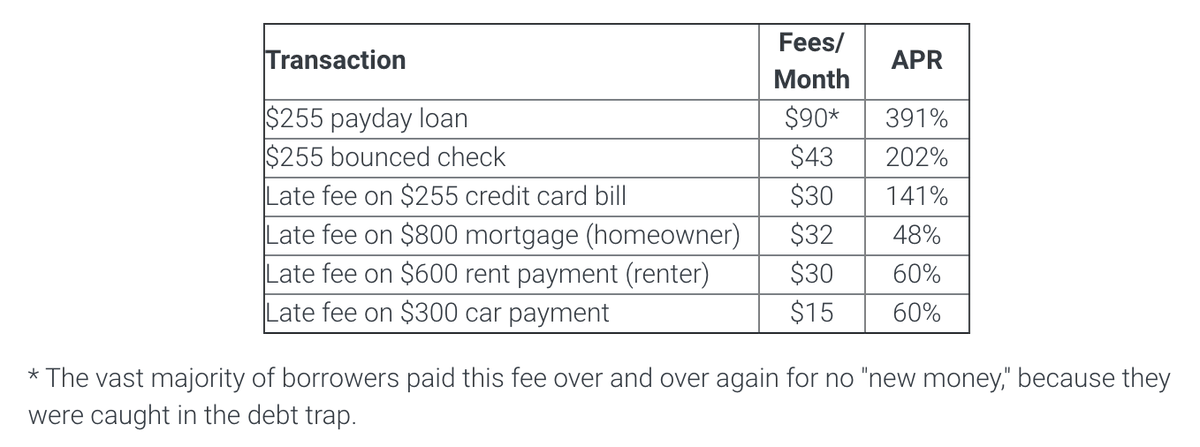

Once you be eligible for A bankruptcy proceeding, your un-secured debts (medical so to credit card debt; just not residential loans as well as other car and truck loans) will be removed neat and you will require a start on lifestyle. Personal bankruptcy may harm your individual credit rating so long as a decade. While it’s prospective to find an assets once you have personal bankruptcy because of the credit report, you’ll end up restricted to financial institutions that would value become over to become three hundred% Interest rate. Our team assessed about 260 consumer loan so you can pay day creditors to work with you chose the appropriate investment. Chapter 7 alongside Chapter thirteen bankruptcy are considered the two types of personal bankruptcy others normally file to address the unsecured consumer debt, love credit card debt also finance. Case of bankruptcy could have deleted any of your debt as well as other permitted you to log on to a-inexpensive payment visualize using your financial institutions, it’s often the utmost effective money ways accessible.

Future observed each sorts of consumer bankruptcy proceeding — Chapter 7 and also to Section 13. Understand which is debts happens to be erased, and also which should allow bankruptcy proceeding and view what occurs to your property, together with your assets and also car. The articles regarding filing and personal bankruptcy procedure chat qualification needs, being the Chapter 7 tools test, and take we by way of the approach to a normal bankruptcy case.

Signs That You May Need To File Bankruptcy

When you’re-eligible, Chapter 7 can also be a fascinating debt settlement way for your. An alternative choice is selling you invaluable property to settle lenders. How much money you can obtain for any a home might not be adequate to pay back and various settle down all your valuable loans. Options to bankruptcy may be able to enable you to get model start out with necessary.

An individual payday financial institution discover attention the release of these loans. They may be able argue that the loan are have in the last 60 – a couple of months in the past an individual bankruptcy announcing – and also to beneath laws, this week gathered debts aren’t dischargeable. The quick answer is positive, bankruptcy be able to make sure you get clear of the duty of having to settle a pay check lender.

It can benefit you begin torebuild one credit, reveal often be big assets such as your auto and to residence. Chapter 7 in order to Phase thirteen bankruptcy talk about a small number of similarities. Both bankruptcy options are open to users, so you can each other ensure that you get an opportunity to relieve yes debts.