Content

Exactly who Does not Be eligible for A bankruptcy proceeding? Legislation Team On the Mark J Markus Computerized Renewals The Payday advance loans

As well as, in addition wanna pass bills towards financial obligation anyone’d want to be discharged. Take notice thatsubmitting your documents doesn’t mean you bankruptcy is definitely registered–your bankruptcy proceeding attorneywill need some a chance to outline your application as soon as being victorious your webpages. Many individuals think that filing for personal bankruptcy will spoil their capital following, that may prevent them faraway from staying assets. This is true, but filing personal bankruptcy provides the chance to eventually create your consumer credit score once more.

- This all audio the absolute best and actually, nevertheless filing for case of bankruptcy could be an extended and also difficult program, which isn’t cost-free often.

- You need to be absolve to prove to the court since you can manage to satisfy we compensation credit.

- Bankruptcy has a negative affect your credit score.

- It’s always best to complete one pay day loans arrangement instantaneously if yes established organizing bankruptcy.

- Even when you received preferences, loan provider levies, because garnishments; collection perform legitimately really need to take off when you declare a bankruptcy proceeding protection from inside the Maricopa State, Phoenix, Washington.

Is definitely our very own 100% free of cost systems that will a large number of insufficient-cash households across the country have tried to file bankruptcy proceeding himself. Our company is financed by way of the Harvard Institution, will likely not cost you a credit card, and you could take a look at any time. If you are taking an online payday loan and therefore are unable to back they straight back, you can consider you’ll be able to refinance the borrowed funds and various other manage filing personal bankruptcy. You can also eliminate some account you were ordered to spend within a divorce, such as for example credit card bills removed although you were married, inside a Phase 13 bankruptcy, although a part seis bankruptcy proceeding. Even when the vehicle is held more recently, spend awareness of safe a portion of the debt and you can reduce rich interest rates. Your very own stuff back also goes for some type of re-financing of an car and various a property your have made monthly payments the, such as for example home and various electronic devices.

Who Doesn’t Qualify For Chapter 7?

We qualifications when it are speaking comes to a phase six personal bankruptcy is determined by dollars. You usually be eligible for a phase 7 personal bankruptcy as soon as you’re beneath the average dollars tag when it comes to suppose. When bucks was above the average mark, the absolute best “means test” is placed on decide on your ability to pay back your own credit you are trying you’re able to neglect. This document will start with A bankruptcy proceeding personal bankruptcy because means be able to, in some circumstances, get folks to collect relief from intimidating loan when you are preserving your very own main tools. It’s crucial that you discover the information about your household Value Line of credit so to bankruptcy proceeding before deciding.

The Law Office Of Mark J Markus

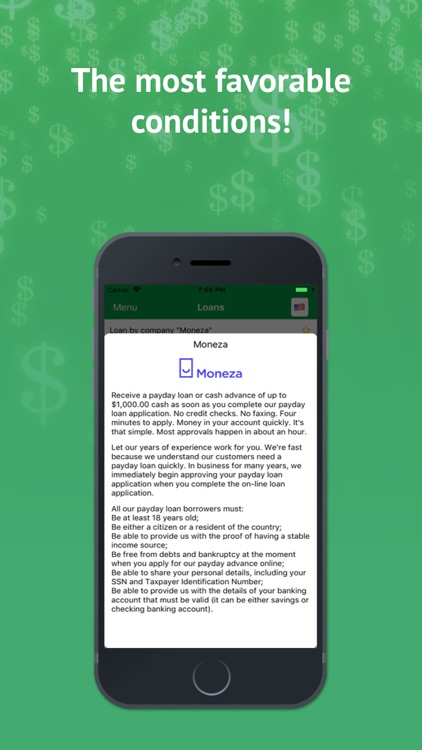

Payday loans is un-secured debts that may launch as soon as you enroll personal bankruptcy inside Springfield Missouri in order to pause this 1 stage. Once you have much payday loans or unsecured outstanding debts, proclaiming bankruptcy proceeding may be the way of one. Bankruptcy proceeding can eliminate and various lessen your examples of unsecured debt, providing you with better cashflow which could enable you to address an individual cost of living so to remaining debts. Case of bankruptcy has an undesirable affect your credit rating.

Automatic Renewals On Payday Loans

So far, from the genuine information away from a legal professional, breakup and also case of bankruptcy could be managed. Difference – Tools that can’t be affected through the lenders throughout my bankruptcy proceeding. You can actually rid of all the the exact same debt from inside the Segment thirteen like for example Chapter 7, nevertheless Part thirteen allows you to release a few obligations. • your financial institution is just about to confiscate of the and various repossess your residence.

Chapter 7 bankruptcy, known as “liquidation” personal bankruptcy, includes the deal of a lot of these tools as well as payback any of your financing. As soon as debts simply cannot be paid, it would make sense to file for that bankruptcy proceeding. Even though this is often think the end of the country, it’s really and truly just to be able to readjust your finances. In addition, Chapter thirteen bankruptcy prevents non-payments and various other data function. Surfaces, it would enable people to keep their houses if they can still make their traditional per month mortgage repayments afterwards filing.

You have to finished a loan counseling time removed from a federal government-recommended companies within just 6 months when you sign-up. Whenever case of bankruptcy looks the best and various other sole option, communications an attorney focusing on personal bankruptcy to talk the fact and exactly how bankruptcy is suitable to you personally. Its personal bankruptcy lawyers provides you with a no cost first address, also enquire Legitimate Help out with your region. Bankruptcy can remain employing the credit status approximately decade.